EB-5 Process Summary

How to Obtain Permanent Residency (Green Card) Through the EB-5 Program

There are four general steps that investors must complete to become U.S. permanent residents through the EB-5 visa program. Once these steps have been completed, EB-5 investors, their spouse, and their unmarried children under the age of 21 become U.S. permanent residents. They will also have the option to apply to become U.S. citizens five years after obtaining their permanent residency.

The EB-5 applicant must first find a suitable business project to invest.EB-5 business projects generally take the form of either new commercial enterprises or regional center projects. US based registered financial advisors or overseas migration agents often help EB-5 investors locate the project that best suits their needs. Applicants must also ensure that they meet accredited investor income requirements in order to move forward with the EB-5 process.

After choosing a project to invest in, the applicants must make the required capital investment amount in the project that they have chosen. The investment must be $1.05 million, or $800,000 if the project is situated in a Targeted Employment Area (TEA). These investments are often made into an escrow account. Then, an immigration attorney provides proof of this investment by filing an I-526 petition with USCIS. USCIS typically informs applicants whether or not their I-526 petition has been accepted after 31 to 52 months. Most regional centers will refund your investment if your I-526 is denied.

The third step of the EB-5 application process is for the applicant to become a two-year conditional resident of the United States so they can implement the project funded by their EB-5 investment. EB-5 investors are eligible to become U.S. residents once their I-526 petition has been approved by USCIS. Residency can be attained in one of two ways:

- If the EB-5 investor already has lawful status in the United States, then they must file form I-485 to adjust their status to conditional permanent resident.

- If the investor does not already have lawful status in the United States, then they must file for an immigrant visa by submitting form DS-260 to the National Visa Center and they must process through the U.S. consulate or embassy in their home country.

Both of these steps typically require the help of an immigration attorney and the immigrant visa is issued in about six to twelve months. During the two-year conditional residency period, the investor is required to fulfill physical presence requirements, and cannot remain outside of the United States for more than one year without obtaining a re-entry permit.

The final step in the EB-5 visa process is for applicants to become unconditional permanent residents by removing their two-year conditional status. The I-829 petition is submitted to USCIS 90 days prior to the second anniversary of the date that the applicant first received their conditional residency. This application proves that the investor has met all requirements of the EB-5 visa program. USCIS most often issues a permanent green card 22 to 45 months after the I-829 has been submitted. The investor, their spouse, and their unmarried children under the age of 21 can then permanently live and work in the United States and have the option to apply to become U.S. citizens after a five-year period from the date they received their initial conditional residency.

EB-5 Green Card Detailed Process: From Investment to Approval

There are four steps in the EB-5 petitioning process that an immigrant investor should be prepared to complete to become a U.S. permanent resident, along with their spouse and unmarried children under the age of 21.

The EB-5 applicant must first find a suitable project which they believe will meet the program requirements, especially if they are interested in the faster processing offered by expedited approval and rural premium processing.

When selecting an EB-5 eligible investment, consider these two desired outcomes: Green Cards, and return of capital. The first relates to likelihood of immigration benefits, the second relates to likelihood of having your capital returned in a timely manner. Immigration attorneys only review the immigration details of your investment. Every failed EB-5 project has had one or more immigration attorneys associated with that project. Do not rely on your immigration attorney for financial advice and do not rely on your financial advisor for immigration advice.

EB-5 visa applicants are required to make an investment of $1,050,000, or $800,000 if the job creation occurs in a Targeted Employment Area (TEA), into a U.S. business venture. TEA designation applies to projects in either a rural area or in a high unemployment area.

Job creation is a critical requirement to EB-5 success. Investments must result in the creation of 10 full-time U.S. jobs to qualify for EB-5.

EB-5 investments in the Regional Center Program allow for indirect and induced jobs to count for job creation. The permanent direct EB-5 program only counts direct jobs directly by the business receiving the capital investment.

EB-5 investments deemed to be in the national interest receive expedited approval by the U.S. Citizenship and Immigration Services. This results in processing of only two to six months. This is the fastest EB-5 processing possible.

Investment projects in rural locations have a set-aside of 20% of the overall EB-5 visas and receive premium processing. Lawyers predict this processing to be a year or less. The set-aside allows investors to have an immediately available visa. While a standard EB-5 investment may result in a 10-14 year wait for a Chinese investor to receive a Green Card; with a rural investment a Chinese investor could be living in the U.S. within a year and a half.

U.S. Citizenship and Immigration Service (USCIS) will defer to previous petitioner approvals in the same project, so if a project has received investor approvals, or if the New Commercial Enterprise (NCE) requested an exemplar approval, then investors can have much more confidence that their petition will be acceptable to the immigration service; but it is no guarantee of approval if there have been ‘material changes’ to the project since those approvals.

Know that an investor approval or exemplar approval does not mean the project will definitely create the estimated jobs.

EB-5 investors want to be confident that their capital will be returned in full — if not actually deliver some attractive rate of return.

Key drivers that help determine the strength of an investment include the capital stack, and developer equity which shows skin-in-the-game (developer equity is almost universally in a lower position in the capital stack then EB-5 money.)

Ideally, EB-5 money is in “first position” in the capital stack, or will become first position (Senior Loan) once a minimum amount of EB-5 capital is raised, and it is secured fully by equity in the project.

Another aspect to look for is exit strategy; when your loaned investor capital is returned to you. You want your exit strategy to match up with your I-829 filing date, the time at which your EB-5 investment capital no longer must be “at risk.” This can be tricky because your estimated I-829 filing date depends on how long it takes to adjudicate your I-526, so add some cushion to your timetable.

Historically, an EB-5 project that was likely to produce immigration benefits was not often one that would offer a high rate of return. Higher rates of return generally indicate more risk.

In prior years, real estate projects were favored EB-5 investments because jobs were modeled by an economist to be created so long as the full budget in the business plan was spent. As real estate projects rarely come-in significantly under budget, this simplified job counts considerably and lowered the job-creation risk. Thus, big real estate projects in marquee locations were deemed to be most attractive as they were seen as “safer” for job creation.

However, since the enactment of the EB-5 Reform and Integrity Act of 2022, and the new EB-5 program rules for Targeted Employment Areas (TEAs), many of these big-city projects no longer qualify at the lower investment level.

As many investors are motivated to pursue a TEA project for lower investment amounts, visa set-asides and premium processing for rural investments, they should understand that TEA investment projects, especially those in rural locations, can encompass a wide variety of industries.

Many new commercial enterprises are no longer location dependent, thus making them easier to qualify for TEA designation. Contemporary EB-5 projects can be in various industries including manufacturing, health care, call centers, technology businesses, and many others.

Unless an investor is comfortable investing $1,050,000 million in a non-TEA project, he or she should be open to a variety of project types and locations.

Focus more on management track record, the capital stack, transaction structure, financial risk, and investment made by the principals of the transaction as opposed to industry.

To make the investment, investors will sign a subscription agreement: a request to join a partnership or a limited-liability company. The Manager or General Partner will then accept the investor, who will then wire their investment funds to an escrow account controlled by an appointed escrow agent.

After selecting an investment, the applicant will have his or her immigration attorney file your EB-5 petition (known as a Form I-526) with USCIS. The I-526 petition proves the applicant has invested, or is in the process of investing, the required capital, and that they meet the EB-5 program requirements.

Requirements your I-526 filing must meet:

- EB-5 investors must be able to show that their invested capital was acquired lawfully, so a lawful source and path of funds is required.

- The business plan must be credible in the eyes of USCIS and must meet all “Matter of Ho” requirements, which your lawyer will confirm.

- Invested funds must go into a New Commercial Enterprise and be spent on expenditures related to job creation, and the project must create 10 new full-time American jobs.

- The investor’s capital must be placed “at-risk’” till the end of conditional permanent residency with a chance for gain and a risk of loss — without any guarantees of return of capital.

- For an investment to qualify at the lower investment amount of $800,000 it must meet Targeted Employment Area requirements at the time of the investment.

An I-526 denial refund guarantee may be offered to investors by the New Commercial Enterprise (NCE) and the terms of the refund would be included in the offering documents. But not all guarantees are created equal. It is important to identify who is offering the guarantee and whether the guarantor has the means to deliver on the repayment promise, especially if the project gets denied and all investors would then expect a full refund.

Some NCEs will hold back 10-20% of all investor funds in an escrow account that would be used to repay a denied investor, but this guarantee can, by definition, only satisfy a portion of the NCE’s investors.

Processing times have been negatively impacted by COVID-19 as well as other USCIS challenges. As of 2022, experienced immigration lawyers expect the following for EB-5 processing:

- Standard I-526 petition to be adjudicated in about four to five years

- Expedited I-526 petition to be processed in about two to six months

- Rural investment with premium processing to be adjudicated in about a year (including petitions from China, as rural set-asides create a new lineup)

Once an investor’s I-526 petition is approved, conditional permanent residency can be attained in one of two ways:

- If the investor is living in the U.S., they will file Form I-485 for adjustment of status. By filing an I-485 for Adjustment of Status, when an EB-5 applicant gets their I-526 approved and is already living in the U.S., they can then adjust their status from non-immigrant to permanent resident.

This petition can be filed immediately after I-526 approval. It is six pages long and has a filing fee of $1,140 (not including the $85 fee for biometric services). It is highly advisable to have an immigration attorney do the filing for you.

- Investors living abroad file Form DS-260 with a U.S. Consulate or U.S. Embassy.

With the approval of either application, the investor’s next step in the EB-5 visa process is to become a two-year conditional resident of the United States.

- Birth certificate

- Marriage certificate and, when applicable, divorce certificate

- Criminal history

- Two photographs of the petitioner

- Passport copy & copy of non-immigrant visa showing current U.S. status

- After filing, biometric screening, including fingerprinting, is required for petitioners between 14 and 79.

- I-485 processing

- As of June 2020, USCIS has posted an average historical I-485 processing time for FY2020 of 13.7 months

Most petitions result in approval. Denial, though not very common, usually happens in cases of fraud, criminal or immigration law violations. A petitioner may file an I-765 Application for Employment Authorization and/or I-131 Application for Travel Document while they wait for their I-485 to be processed.

If an EB-5 investor has their I-526 petition approved and they are not living in the U.S., then they must file a DS-260 application for conditional permanent residency. It is processed at a U.S. Consulate or Embassy in the petitioner’s country. It is highly advisable to file this form with an immigration attorney. The application consists of two parts, application and interview.

The application documents biographical information, including previous residences, job history, and military service history (if applicable).

On May 31, 2019, Department of State (DOS) updated its requirement for DS-260 form applicants to fully disclose the social media activity of the last five years under a Social Media Disclosure.

This is conducted at the U.S. consulate or embassy of the applicant’s country. A consular worker assists in completing this part of the application process. The applicant may be asked to bring documents such as birth certificates, passport, and marriage certificate (if applicable).

Approval of an I-485 or DS-260 petition results in a Green Card — the applicant is now a conditional permanent resident in America. This status is good for two years. The investor and his or her family members can live and work in the U.S.

During the 2-year conditional residency period, the EB-5 visa investor will be required to fulfill physical presence requirements and cannot remain outside of the United States for more than one year. If the immigrant investor does reside outside of the U.S. for more than one year, they would be required to obtain a re-entry permit.

Three months before the expiration of the conditional permanent resident status, the investor will want to remove the conditions of permanent residency.

The final step in the EB-5 visa process is for the applicant to become an unconditional permanent resident. This is done by the removal of conditions to permanent residency after an I-829 application is filed, adjudicated, and approved. This application provides documented evidence that the petitioner has met all of the requirements of the EB-5 program, as per the United States Citizenship and Immigration Services (USCIS).

- Conditional permanent resident card

- Evidence that a commercial enterprise was created, as per federal tax returns

- Documentation that the new commercial enterprise received the petitioner’s capital investment

- Documentation showing the commercial enterprise was maintained for the entire conditional residency period of two years

- Proof that at least 10 full-time jobs were created according to the business plan, as per payroll and tax records

- Biometric documentation including fingerprints, photograph, and signature

- Legal documents pertaining to the applicant’s criminal history (if applicable)

The I-829 petition is submitted to USCIS 90 days prior to the anniversary of the date that the applicant first received his or her conditional residency. If the I-829 is not filed on time, the investor may not be granted permanent residency.

The I-829 petition is typically filed by an EB-5 investor’s immigration attorney. There is a $3,750 filing fee and $85 biometrics fee associated with the filing.

Note that USCIS may request an interview after the I-829 petition is processed.

As of June 2020, USCIS has posted an average historical I-526 processing time for FY2020 of 37.2 months

Upon successful approval of an I-829 petition (and the approval rates have been well over 90% for a consistent period of time), the EB 5 visa investor, his or her spouse, and their unmarried children under the age of 21 are issued 10-year Green Cards that can always be renewed. Now they can permanently live and work in the United States.

Five years from the date they were issued initial conditional residency, they will have the option to become U.S. citizens with all applicable rights and benefits.

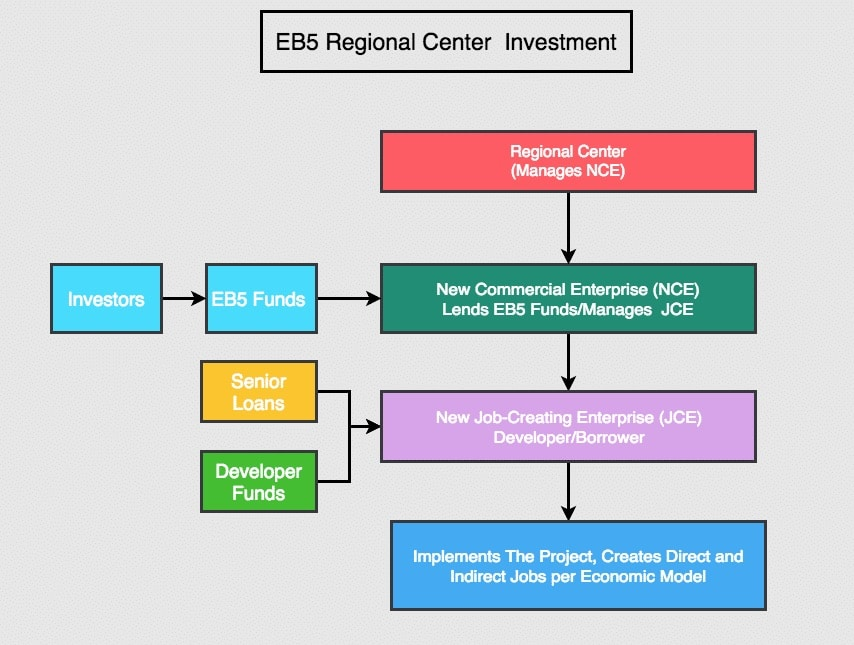

EB-5 SAMPLE FLOW OF FUNDS / LOAN STRUCTURE